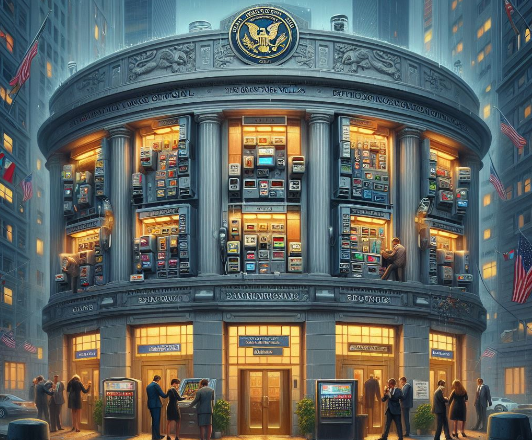

In the intricate world of financial regulation, the Securities and Exchange Commission (SEC) serves as a vigilant guardian, ensuring transparency and integrity within the financial sector. Central to its enforcement procedures is the issuance of Wells Notices, formal notifications signaling potential enforcement actions against individuals or entities. In this article, we delve into the significance of Wells Notices, their implications for recipients like Brook Taube, and the intricacies of managing SEC enforcement proceedings.

Understanding the Importance of Wells Notices

Wells Notices hold profound significance in the realm of securities regulation. These notices, named after the landmark case SEC v. Jerry T. O’Brien, serve as a crucial step in the SEC’s enforcement process. Issued to individuals or firms under investigation, Wells Notices provide recipients with the opportunity to respond to the allegations and present their case before the SEC makes a final determination on whether to pursue enforcement actions.

Effects on Brook Taube Wells Notice and the Financial Sector

For individuals like Brook Taube and firms operating within the financial sector, receiving a Wells Notice can have far-reaching implications. Beyond the immediate scrutiny and potential enforcement actions, Brook Taube Wells Notice can impact reputations, investor confidence, and business operations. The specter of enforcement proceedings looms large, necessitating strategic responses and diligent navigation of regulatory requirements.

Managing SEC Enforcement Proceedings

Effectively managing SEC enforcement proceedings requires a comprehensive understanding of the regulatory landscape and adept legal counsel. From conducting internal investigations to crafting robust defense strategies, recipients of Wells Notices must navigate a complex web of regulatory scrutiny and legal proceedings. Proactive engagement and cooperation with regulatory authorities are essential elements in mitigating potential adverse outcomes.

Responding to a Wells Notice: Procedure

Responding to a Brook Taube Wells Notice entails a meticulous and strategic approach. Upon receipt of the notice, recipients typically have a specified timeframe to submit a written response outlining their defense and addressing the allegations raised by the SEC. This response serves as a critical opportunity to present evidence, refute allegations, and demonstrate compliance with securities laws and regulations.

Possible Results of Wells Notice Proceedings

The outcome of Wells Notice proceedings can vary significantly, ranging from no further action to settlement agreements or formal enforcement actions. Factors such as the strength of the evidence, mitigating circumstances, and cooperation with regulatory authorities can influence the final resolution. Regardless of the outcome, navigating Wells Notice proceedings demands vigilance, resilience, and adept legal representation.

The Contribution of Legal Advisors in Wells Notice Proceedings

Legal advisors play a pivotal role in guiding recipients through Wells Notice proceedings. Drawing on their expertise in securities law and regulatory compliance, legal counsel provides invaluable support in formulating defense strategies, conducting investigations, and engaging with the SEC. Their guidance empowers recipients to navigate the complexities of enforcement proceedings with confidence and diligence.

Summary

In summary, the issuance of Wells Notices by the SEC represents a critical juncture in the enforcement process, signaling potential regulatory action against recipients. For individuals and entities operating within the financial sector, receiving a Wells Notice underscores the importance of proactive compliance efforts, strategic response strategies, and expert legal counsel. Navigating Wells Notice proceedings requires diligence, resilience, and a nuanced understanding of regulatory requirements.

FAQ

What is a Wells Notice?

- A Wells Notice is a formal notification issued by the Securities and Exchange Commission (SEC) to individuals or entities under investigation, indicating potential enforcement actions.

What is the significance of receiving a Wells Notice?

- Receiving a Wells Notice signifies that the SEC is considering pursuing enforcement actions against the recipient based on alleged violations of securities laws and regulations.

How should recipients respond to a Wells Notice?

- Recipients of Wells Notices should promptly engage legal counsel to formulate a comprehensive response addressing the allegations raised by the SEC, presenting evidence, and outlining defense strategies.

What are the possible outcomes of Wells Notice proceedings?

- The outcomes of Wells Notice proceedings can vary, ranging from no further action to settlement agreements or formal enforcement actions, depending on factors such as the strength of evidence and cooperation with regulatory authorities.

How can legal advisors assist in Wells Notice proceedings?

- Legal advisors provide essential support in guiding recipients through Wells Notice proceedings, offering expertise in securities law, regulatory compliance, and defense strategies to navigate the complexities of enforcement actions effectively.